We have seen a change since January 2025. So what is happening in Melbourne, Florida?

The Melbourne, Florida housing market in 2025 presents a nuanced landscape, reflecting a balance between stability and subtle shifts. Here's an in-depth look at the current trends and what they mean for buyers, sellers, and investors.Movoto Real Estate+5Bankrate+5Zillow+5

🏡 Market Overview: Stability Amid Subtle Shifts

As of April 2025, Melbourne's median home sold price stands at $410,205, marking a modest 0.3% increase from the previous year. The median price per square foot is $234, indicating a steady market without significant volatility.Rocket

However, the average home value has experienced a 3.5% decline over the past year, settling at $367,926. This suggests that while median prices remain stable, the overall market is experiencing slight downward pressure.Zillow

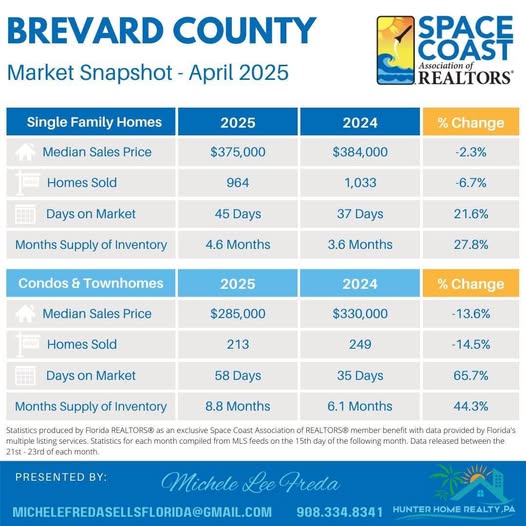

📊 Inventory and Sales Dynamics

The market is currently balanced, with supply and demand in equilibrium. Homes are spending a median of 58 days on the market, reflecting a steady pace of sales.Realtor

Notably, the number of homes sold in April 2025 increased to 1,850 from 1,495 the previous year, indicating heightened buyer activity. This uptick in sales volume suggests growing confidence among buyers, even as prices remain relatively stable.Movoto Real Estate

🏘️ Neighborhood Variations

Different areas within Melbourne are exhibiting varied trends:

-

Indialantic-Melbourne Beach: Median sold price decreased by 3.6% year-over-year.

-

Indian Harbour Beach: Experienced a 3.7% decline in median sold price.

-

West Melbourne: Saw a 4.6% drop in median sold price.

These variations highlight the importance of localized market analysis when considering real estate investments or purchases in the area.

🏢 Condos and Land: Diverging Trends

The condo market has seen a significant increase in average list prices, reaching $492,398 in May 2025, up 10% from the previous year. Conversely, the land market has experienced a decrease in average list prices, dropping 19% year-over-year to $1,324,962. My Broker One

These contrasting trends suggest a growing demand for ready-to-move-in properties, while raw land may be facing challenges due to development costs or regulatory hurdles.

🔮 Looking Ahead: What to Expect

The Melbourne housing market is expected to maintain its balanced state in the near term. While some areas may experience slight price adjustments, the overall market shows resilience. Factors such as employment opportunities, population growth, and interest rates will continue to influence market dynamics.

💡 Conclusion

Melbourne, Florida's housing market in 2025 is characterized by stability with pockets of change. For buyers, this presents an opportunity to enter the market without the pressure of rapidly escalating prices. Sellers can expect steady demand, particularly in well-located and well-maintained properties. Investors should pay close attention to neighborhood-specific trends to identify areas with the most potential for appreciation.

As always, partnering with a knowledgeable local real estate professional can provide invaluable insights tailored to individual goals and circumstances.